A Boy in Japan Spent Three Weeks Piecing Together 10,000 Yen That Were Accidentally Shredded

A Japanese Twitter user named Tomo recently completed one of the most challenging puzzles.

Read More

Lloyd Martin Became Youngest Runner with Down's Syndrome to Complete Marathon

Lloyd Martin has wanted to run a marathon for years.

Read More

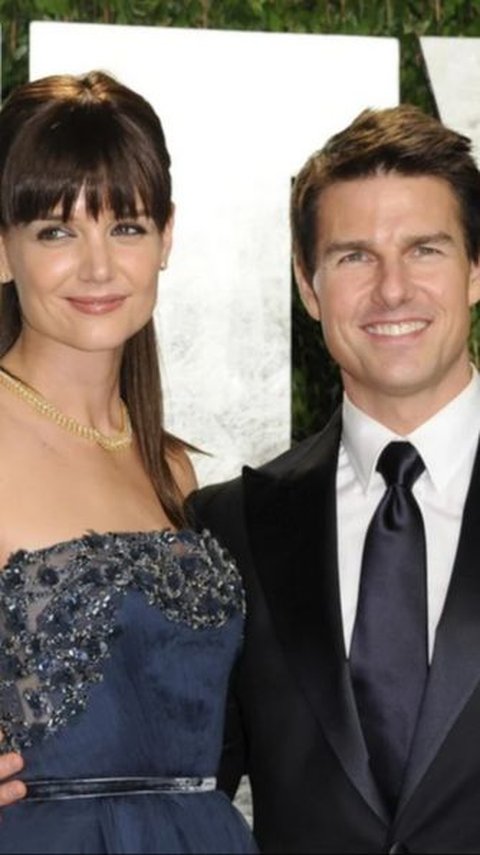

Tom Cruise No Longer Gives US$400,000 per Year to His 18-year-old Daughter

Tom Cruise's daughter, Suri Cruise, recently celebrated her 18th birthday.

Read More

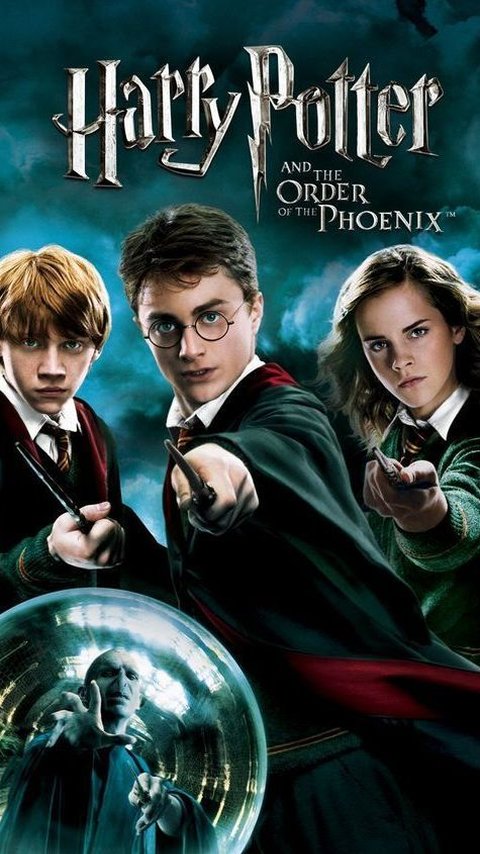

50 Harry Potter Jokes: Hilarious Jokes That Will Tickle Your Funny Bones

If you are a fan of Harry Potter, you should check out these hilarious Harry Potter quotes that will make you rolling on the floor laughing.

Read More

Deadpool and Wolverine Unite to Fight Cassandra Nova in the Latest Trailer

Marvel Studios officially released the latest Deadpool & Wolverine trailer on Monday (4/22) US time.

Read More

35 Family Love Quotes that Capture the Essence of Home

Let's dive into a collection of family love quotes that capture the heartwarming feeling of home.

Read More

Nigerian Man Breaks 58-Hour Chess Record to Raise Money for Education

A Nigerian chess champion has broken the world record after playing for 58 hours without stopping.

Read More

James Hetfield Gets New Tattoo Using Lemmy Kilmister's Cremation Ashes

Metallica frontman James Hetfield shows off a new tattoo on the middle finger of his right hand.

Read More

7 Most Beautiful Female Basketball Players

Here are the top 7 most beautiful female basketball players in the world.

Read More

5 Horror Movies Similar to 'Immaculate'

"Immaculate" is a horror film that follows Sister Cecilia, who is is inexplicably pregnant and said was in immaculate conception

Read More

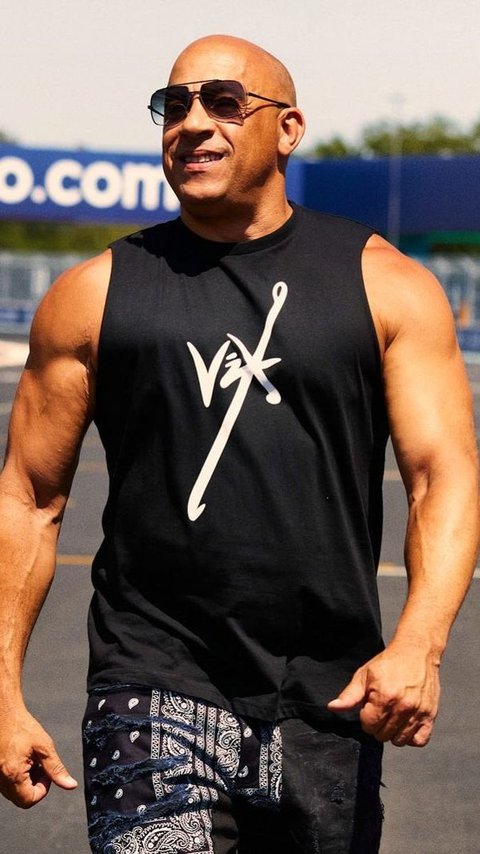

Top 5 Vin Diesel Movies Outside Fast & Furious

Here are the top 5 best Vin Diesel movies outside Fast & Furious you must watch.

Read More

Meet Amanda Nguyen, the First Southeast Asian Woman to Fly in Space

She will be the first Vietnamese Woman to fly to space, according to Space for Humanity.

Read More

25 Life Is Beautiful Quotes to Help You Enjoy Every Moment of Your Life

These life is beautiful quotes will remind you to cherish the moment and find joy in the little things.

Read More

5 Unique Facts About Earth Day You Probably Don't Know

Earth Day is an annual event celebrated around the world on April 22 to demonstrate support for environmental protection.

Read More

7 Best Places to Visit in Argentina

From the lively capital city of Buenos Aires to the charming Ushuaia on the southernmost tip of the world, here are the best places to visit in Argentina.

Read More

42 Tuesday Motivation Quotes for A Productive Week

Tuesday motivation quotes are words of inspiration to help us start our week with energy and enthusiasm.

Read More

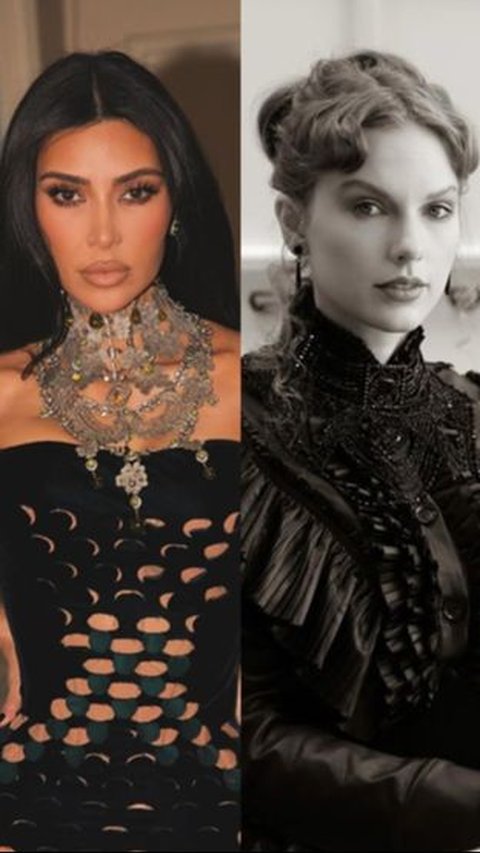

Kim Kardashian Lost Over 100,000 Followers After Taylor Swift 'Included' Her on New Album

Kim Kardashian has been losing about 120,000 followers so far.

Read More

35 Inner Peace Quotes for Peaceful Living and Calm Mind

These inner peace quotes will help you to reach a peaceful life.

Read More

Simple Shortbread Cookie Recipe With Only 4 Ingredients

If you want to make something simple to satisfy your sweet tooth, you should try our shortbread cookie recipe.

Read More

Cave in Kenya Believed to be Source of Ebola

The cave turned out to be home to some of the deadliest viruses in human history.

Read More

How to Wash a Weighted Blanket Properly in 2 Ways

Learning how to wash a weighted blanker properly can help to maintain its cleanliness and hygiene as well as make sure it can last long.

Read More

Pet Loss Quotes: 30 Healing Words for Grieving Hearts

These quotes can also support us during this emotional journey.

Read More

Tom Holland Gives Another 'Update' For The Upcoming Spiderman 4

The 27-year-old actor gives a new statement about the rumored movie.

Read More

30 Determination Quotes to Encourage You to Achieve Your Goals

These determination quotes will spark your spirit to make your dream comes true.

Read More

Fortnite Allows Players to Hide "Confrontational Emotes" in A New Update

"Certain emotes that are sometimes used in confrontational ways."

Read More